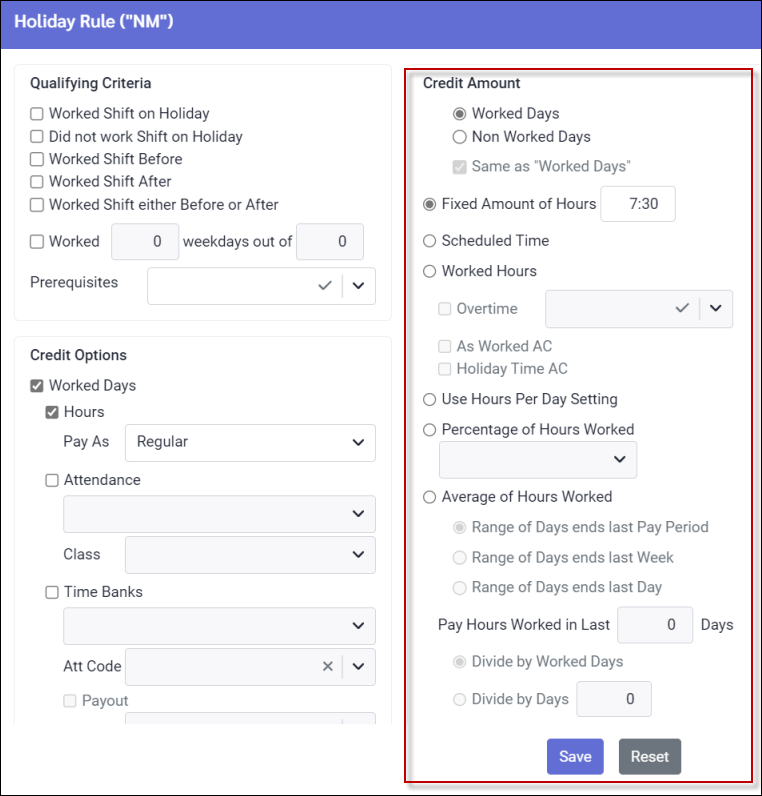

The Credit Amount section provides options to configure the amount of credit the employee will receive for the holiday.

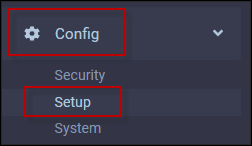

▪Select the Config menu.

▪Select the Setup menu.

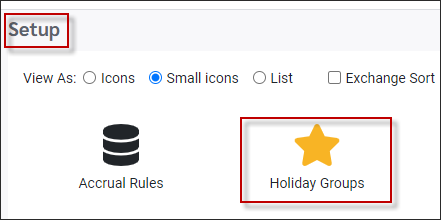

▪Select Holiday Groups.

▪Click on the Holiday Group that you would like to configure the Credit Amount Options for.

▪Click on the Holiday Rules tab.

Credit Amount Options

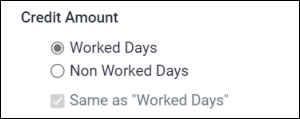

Non Worked Days may be configured to be calculated the same as worked days. Click on the Non Worked Days button to allow the Same As Worked Days button to be clicked.

Fixed Amount of Hours

Allows for a specific amount of time to be entered each time the stat holiday calculation is run.

Scheduled Time

Will look at the Active Schedule for the hours of the shift scheduled on the holiday.

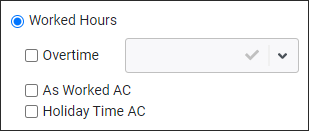

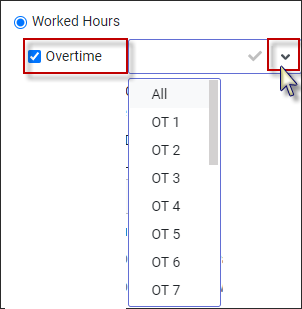

Worked Hours

The holiday hours credit amount will be based on the stat holiday worked hours found on the Time Card. The Attendance Codes that are configured as Holiday Time and / or As Worked may be included. Tick the Overtime box and select which overtimes should be included by selecting them from the drop-down menu, if applicable.

Use Hours Per Day Setting

The holiday credit amount will use the FTE (Full Time Equivalency) field found in Personnel / Shift & Schedule. This number many vary between employee groups (department, class) or individual employees within each group.

![]()

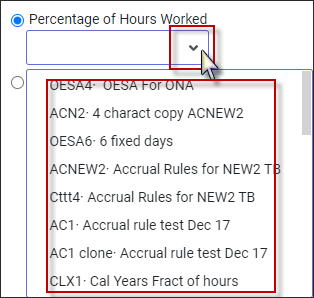

Percentage of Hours Worked

When using the Percentage of Hours Worked option, select which Accrual Rule should be applied. Click on the drop-down arrow for a list of the Accrual Rules.

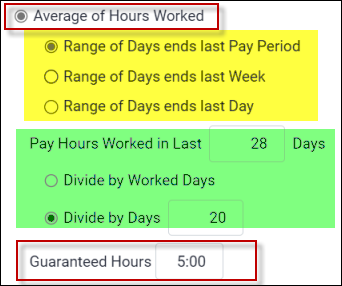

Average of Hours Worked

The holiday credit amount will be based on a calculated average number of hours worked during a specified past time period:

▪Select Average of Hours Worked by ticking the box to enable it.

▪Enter one of the three options (yellow) to indicate when your count back will start. A) Range of Days ends last Pay Period, would start counting back from the last day of the previous pay period. B) Range of days last Week would start counting back from the last day of the previous week. The week start date is determined by the weekday of the Pay Period start date. For example if the Pay Period starts on a Sunday, the system would start counting back from the previous Saturday to correspond with the Pay Period configuration, even if this Saturday is in the middle of a pay cycle. C) Range of Days ends last Day will start counting back from the day before the holiday, regardless of what day the holiday falls.

▪Select how much time you will be counting back in days. For example, if you will be counting back four (4) weeks, enter 28 days.

▪Select how you will divide the time to create the average. For example, if an employee worked 80 hours over the past 28 days, and you select Divide by Days = 20, the holiday credit amount would be four (4) hours (80 hours / 20). If you have selected Divide by Worked Days, the system will base the hours on the number of days worked as per the Time Card. If an employee works two shifts in one day, the system will consider this one worked day since it is not counting shifts, but days.

Guaranteed Hours

This is the number of hours the system would pay as a minimum amount. If five (5) hours is entered here and the calculated amount equals four (4) hours, the system would pay five hours (above).

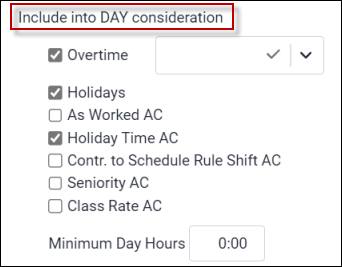

Include into DAY consideration

The Include into DAY consideration options are only available when the credit amount is being calculated using the Average Hours Worked calculation with the Divide by Days option.

▪Select the options that should be included in calculating the hours of a day.

Minimum Day Hours

If you have the rule based on Divide by Worked Days, it can specify the minimum number of hours required to be considered a day. For example, if you enter four (4) hours, a three-hour work day would not quality as a day and would be skipped.

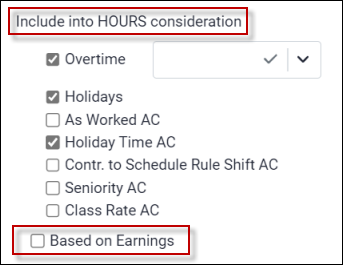

Include into HOURS consideration

These options are only available when the credit amount is being calculated using the Average Hours Worked calculation with the Divide by X Days option (e.g. the total hours over the past 28 days).

▪Select the options that should be included in calculating the hours.

Based on Earnings

If checked, the system will calculate this average credit amount based on earnings not hours. This option may be used if rates are being tracked in the system and if earning from premiums must be included in the average calculation.