Payment Evolution is the system StaffScheduleCare interfaces with for payroll to process paychecks and/or direct deposits. The following sections are listed in order of setup for a new StaffScheduleCare payroll client.

New Client Setup

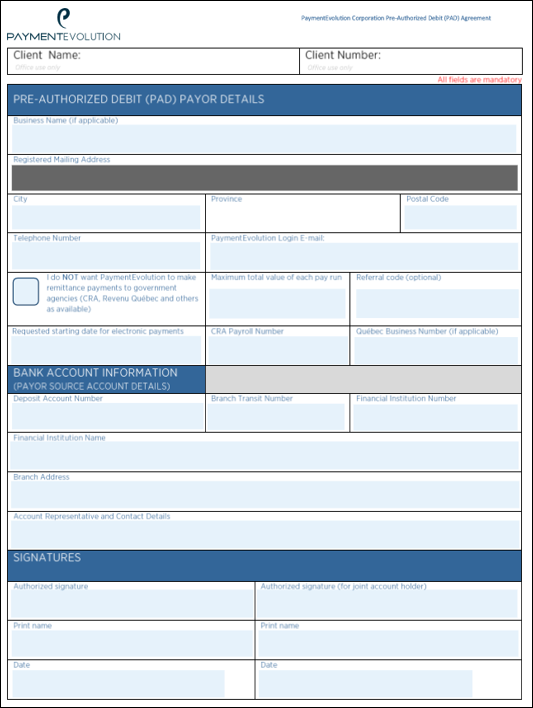

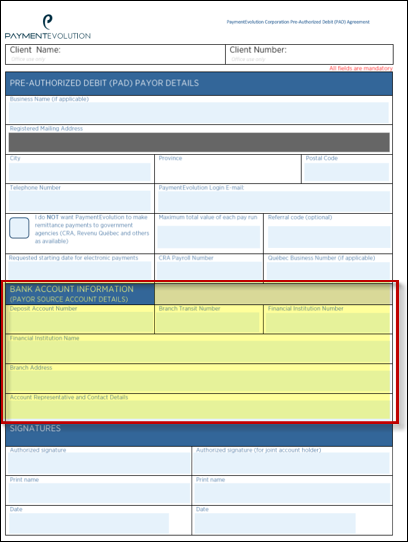

▪Forward the saved Payment Evolution PAD pdf in the course 14 folder. ▪Instruct the client to complete this form (page 3) and provide a void cheque. ▪Once the client has filled out the Payment Evolution Pre-Authorized Debit (PAD) Agreement this information is entered into Payment Evolution.

Sample Payment Evolution PAD agreement.

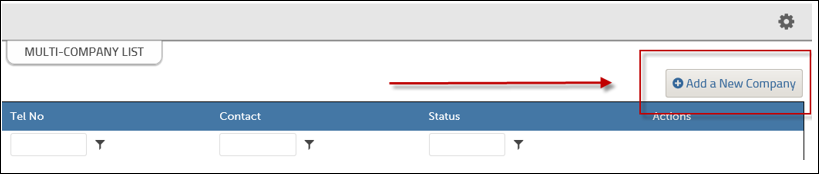

▪Log into Payment Evolution using the authorized log in credentials for StaffScheduleCare. ▪Under the Multi-Company List click on Add a New Company.

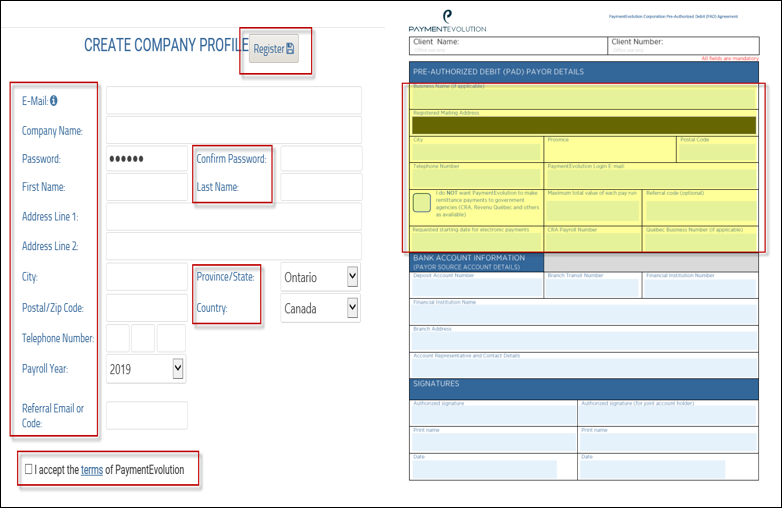

▪Fill in all indicated in red boxes with the information provided in the top part of the agreement. ▪You will need to create a temporary password which the client can change. ▪Password should be $$C1234!a. ▪Once complete click Register.

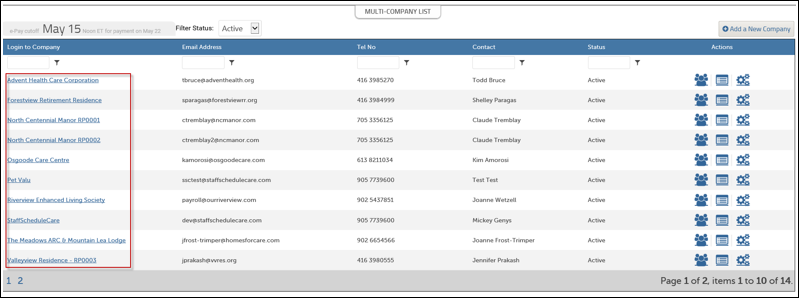

▪After you click Register, go back to the client list in the main menu. ▪You should see your newly created site in the list (you may have to scroll through multiple pages).

▪Select your new site by clicking on the blue name link. This will launch the Payment Evolution setup wizard. Here the remaining banking info from the agreement is entered.

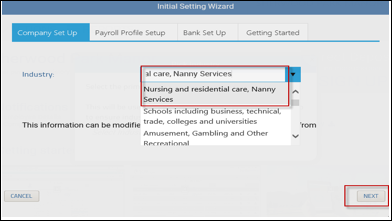

▪Fill in all the banking information into the step by step setup wizard. ▪Once complete select Finish. The site will now need to be finished by Payment Evolution. ▪Using the drop-down menu select the Nursing and Residential Care, Nanny Services option. ▪When finished click Next.

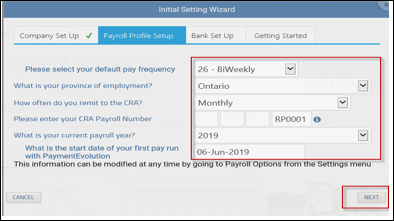

▪Fill in the remaining banking info here. You will need to provide the pay frequency, province of employment, CRA remittance frequency, CRA number, payroll year and first pay run date (usually the Go Live payroll date). ▪When finished click Next.

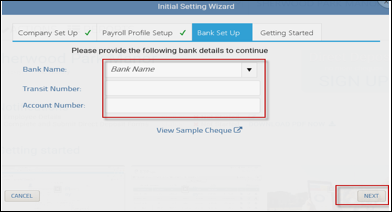

▪Fill in the bank name, transit number and account number. This information will be provided on the E-Pay agreement. ▪When finished click Next.

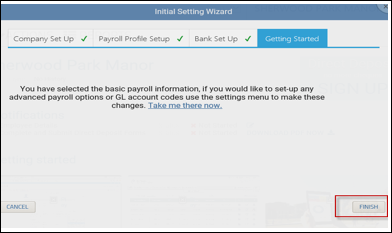

▪When all steps have been completed click Finish to complete the wizard setup.

Contact Payment Evolution ▪Send the following email to support@paymentevolution.com to finish the setup. ▪Replace the facility in bold, with the new site name (must match what you entered in the setup). ▪Send the e-pay agreement and void cheque as an attachment.

Hello, I have just created a new site. Client will only be doing online bill payment. Please setup the following for “INSERT SITE HERE”: ▪CSV Import ▪Upgrade to Pro Account - No limit on the employee count ▪I don’t need the costing turned on If you could turn all this on it would be appreciated. Add your SSC Signature here. You will also need to submit another email to turn the API feature on to allow the SSC system to communicate with the PE software. Copy and paste the following email to support@paymentevolution.com. Hello, Could you please setup the API function for “INSERT SITE NAME”. This is a new site and another email has been sent to configure the account. Please let us know if you require any further information from us. Your SSC signature here.

Payment Evolution Response ▪Wait for the reply email from Payment Evolution saying they have created the new site and any further instructions they may give you. When Payment Evolution emails back saying the account is active they will include an email that we send to the client with details about policy and general info. ▪Copy and paste this info and send it to the client. The email will look similar to below. **Note**: DO NOT copy the email below as it will have information to a different site.

Employee bank account numbers: IIMPORTANT: Remittances will not be sent to the respective government agency until you have clicked ‘End of period’ in the ACTIONS menu of the service. This action must be completed at least 5 business days before the payment due date. The Canada Revenue Agency and Revenue Quebec provide online tools to verify payment. Please check these to ensure on time payment. Please report any discrepancies within 1 business day of the due date so we can work with you to resolve the issue. |

Once the account is live in Payment Evolution you will need to add the account name and token into StaffScheduleCare. To add the account name, select it from Payment Evolution following the steps below:

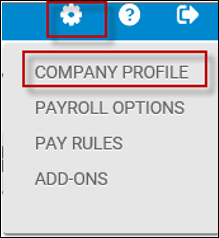

▪Select the Gear Icon in the top right corner. Select Company Profile.

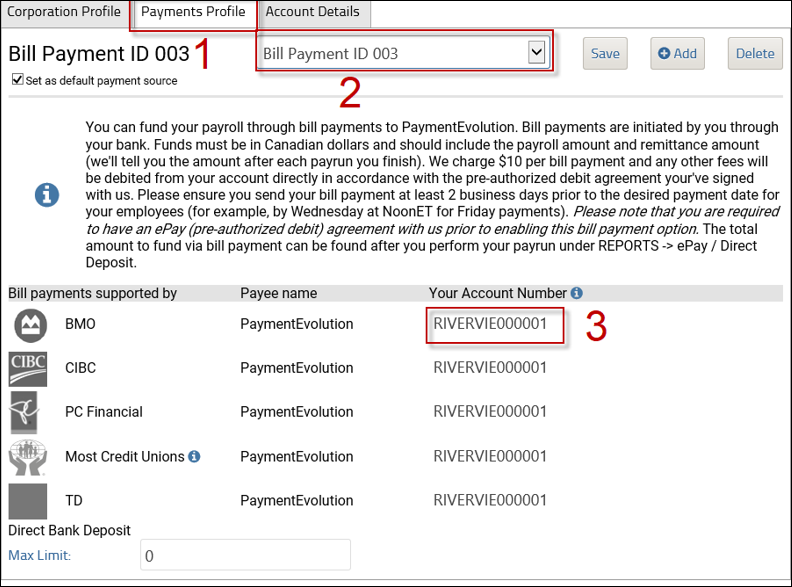

1.Select Payments Profile 2.Bill Payment ID 00x needs to be selected, NOT the bank option. 3.The account number needs to be copied and added to SSC in Payroll / Other / Payroll Interface / General.

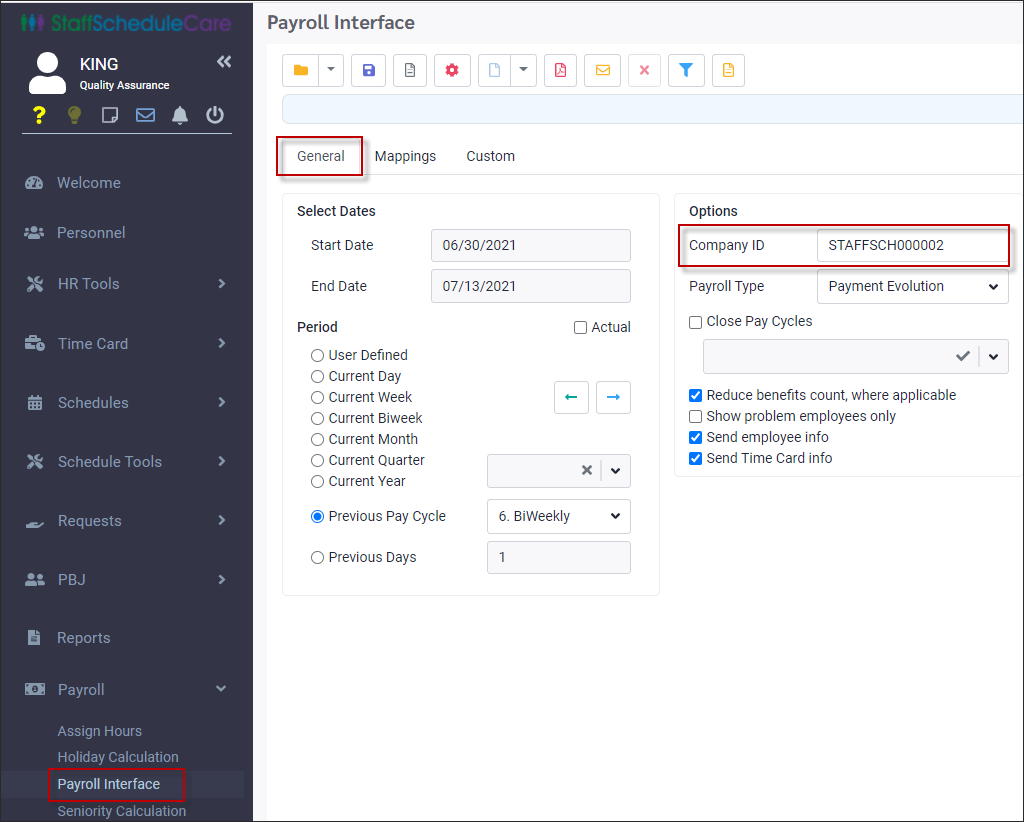

▪Enter the client's Payment Evolution number in StaffScheduleCare. Navigate to Payroll Tools / Payroll Interface.

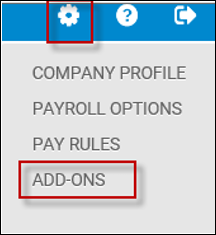

▪Select the Gear Icon / Add-On's. ▪Select API.

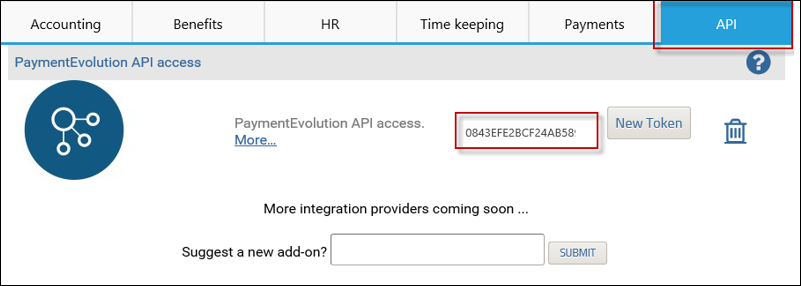

▪You will need to copy the long token number (API). This will be used so StaffScheduleCare can communicate with Payment Evolution.

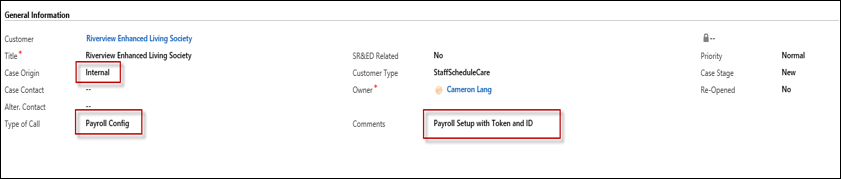

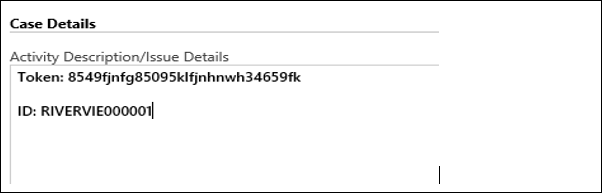

▪Create an ECC IT ticket and add the Token number and Company ID in the ticket as follows:

IT will notify you when the setup has been complete.

|

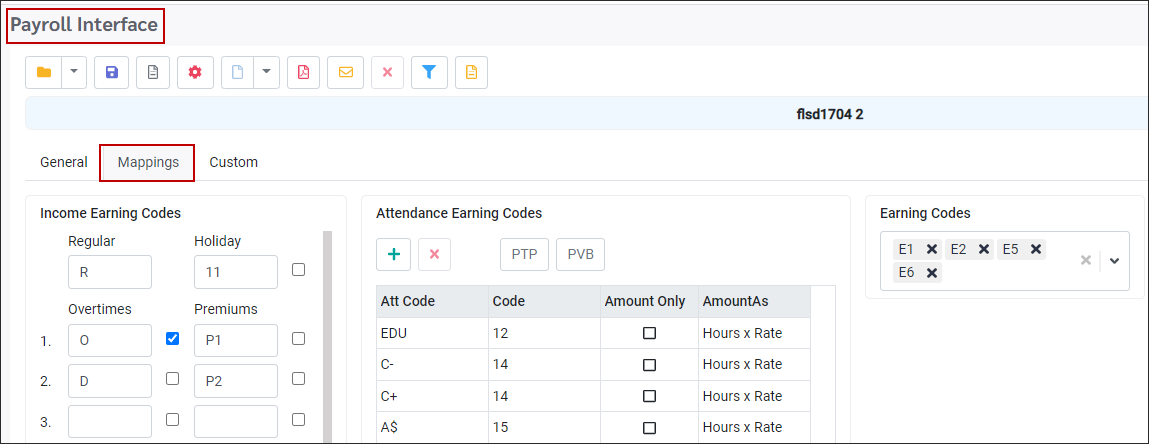

In StaffScheduleCare the earning codes need to be setup. ▪Select the Payroll menu. ▪Select the Payroll Interface menu.

▪Navigate to the Mapping tab.

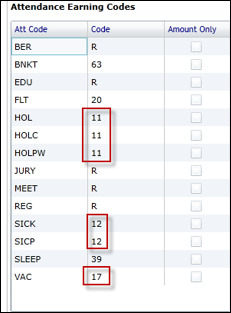

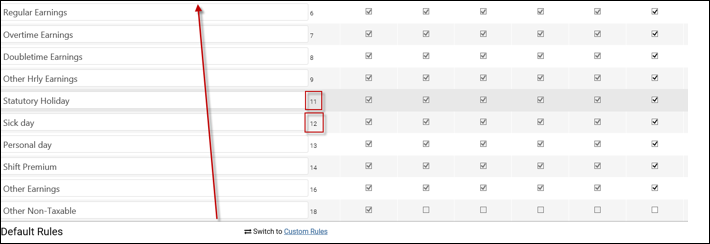

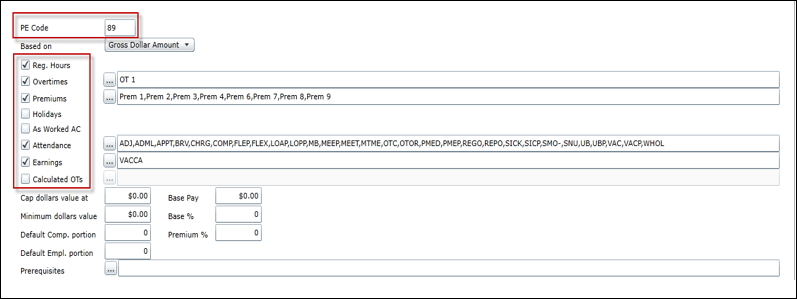

Enter/setup Earning Codes All paid Attendance Codes will be added to this section. Click on the plus symbol (+) to Add. Any codes that contribute to REGULAR earnings will be coded to “R” (you will need to look at the PVB files (if applicable) or ask the client which codes contribute to REG). All other codes will need to be coded using Payment Evolution coding (see below).

▪R = Regular ▪11= Holiday ▪1st overtime = O (not zero) ▪Premiums = Codes in PE (can change)

|

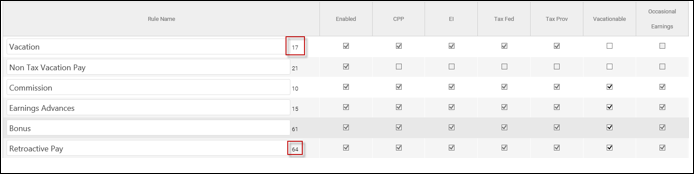

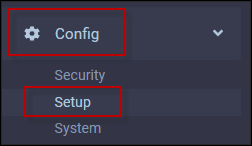

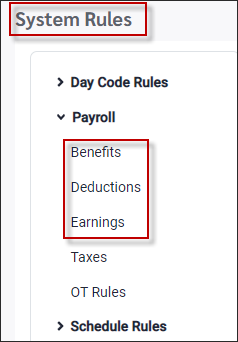

Add the Earnings, Benefits and Deductions to StaffScheduleCare using the list provided by the client. ▪Select the Config menu. ▪Select the Setup menu.

▪Select System Rules. ▪Select Payroll / Benefits. ▪Select Benefits Deductions, Earnings, Taxes.

▪To add the Benefits, Deductions and Earnings click the Actions icon and select Add.

Benefits Code + “ER”. (ex. DENTAL-ER). Benefits are always employer amounts. Deductions Code (ex. DENTAL). Deductions are always employee amounts.

Earnings Code (ex. CELL). Additional earnings on top of regular. As you create each benefit or deduction enter the detail of any attendance codes, premiums, OTs and earnings codes that contribute. This information will be provided by the client.

|